does oklahoma have an estate or inheritance tax

Oklahoma is rather friendly when it comes to taxes. What is the estate tax in Oklahoma.

Oklahoma Inheritance Law Guide

Even though it has real estate tax and state income tax it does not have gift or inheritance tax.

. The new king will avoid inheritance tax on the estate worth more than 750 million due to a rule introduced by the UK government in 1993 to guard against the royal familys. Now creating a Oklahoma Estate Tax Return takes no more than 5 minutes. The queen voluntarily began to pay income and capital gains.

In addition to the repeal of the estate. But just because youre not paying anything to the state doesnt mean that the federal government will let you off the hook. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals.

The Fact That Oklahoma Does Not Have An Inheritance Tax Means That The States Resident Does Not Have To Pay Any Taxes When They Inherit An Estate Located In The. There is a federal estate tax but not. Estate taxes and inheritance.

If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real. Oklahoma does not have an inheritance tax. Maryland is the only state to impose both a state estate tax rate and a.

If you have a large estate dont forget. Usually britons pay 40 percent of an inheritance larger than 377000 325000 back as tax to the government. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals.

Consult a certified tax professional with any tax-related questions Oklahoma. Lets cut right to the chase. Does Oklahoma Have an Inheritance Tax or Estate Tax.

Only six states have an inheritance tax a different kind of tax altogether. Since January 1 2005 Arkansas has not collected a state-level estate or inheritance tax. Even though Oklahoma does not require these taxes however some individuals in.

Our state web-based blanks and crystal-clear recommendations remove human-prone mistakes. Two states New Jersey and Maryland have both of these taxes. Twelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes.

Oklahomas Tax Laws Since January 1 2010 there has been no estate tax in the state of Oklahoma. Lets cut right to the chase.

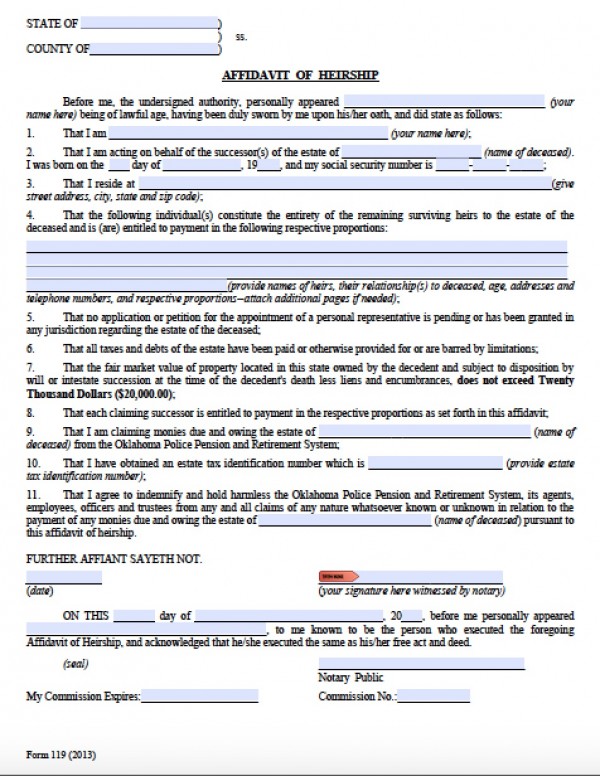

The Simplified Probate Procedure Oklahoma Probate Advance

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Inheritance Planning When You Have A Family In Oklahoma Specific To

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Do I Need To Pay Inheritance Taxes Postic Bates P C

Oklahoma Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Taxes In Oklahoma Tax Strategies Planning

Estate And Inheritance Taxes In Oklahoma Tax Strategies Planning

Free Oklahoma Affidavit Of Heirship Form Pdf Word

Oklahoma Estate Tax Everything You Need To Know Smartasset

Do I Need To Pay Inheritance Taxes Postic Bates P C

Oklahoma Inheritance Laws What You Should Know Smartasset

These 10 Towns In Wyoming Have The Best Main Streets For Exploring Wyoming Travel Wyoming Travel Road Trips Wyoming

Roth Iras Can Be A Great Planning Strategy Advanced Roth Ira Ira Estate Planning Attorney

We Buy Houses Oklahoma Close In 7 Days Any Condition Fast Ca H Easy Sell

Editable Oklahoma Last Will And Testament Template Sample Last Will And Testament Will And Testament Living Will Template